Optimize Your Advantages with VA Home Loans: Lower Passion Fees and Flexible Terms

Optimize Your Advantages with VA Home Loans: Lower Passion Fees and Flexible Terms

Blog Article

Understanding Just How Home Loans Can Facilitate Your Journey Towards Homeownership and Financial Stability

Navigating the intricacies of home mortgage is important for anybody desiring accomplish homeownership and develop financial stability. Various kinds of finances, such as FHA, VA, and USDA, supply distinctive advantages customized to different circumstances, while comprehending rate of interest and the application procedure can considerably affect the general affordability of a home. Handling your mortgage efficiently can lead to long-term financial benefits that prolong past simple possession. As we think about these vital aspects, it ends up being clear that the path to homeownership is not practically securing a financing-- it has to do with making notified options that can shape your economic future.

Kinds Of Home Loans

Conventional finances are a preferred alternative, generally needing a greater credit rating and a deposit of 5% to 20%. These financings are not guaranteed by the federal government, which can bring about more stringent qualification standards. FHA fundings, backed by the Federal Housing Management, are created for first-time homebuyers and those with reduced credit rating, permitting down settlements as reduced as 3.5%.

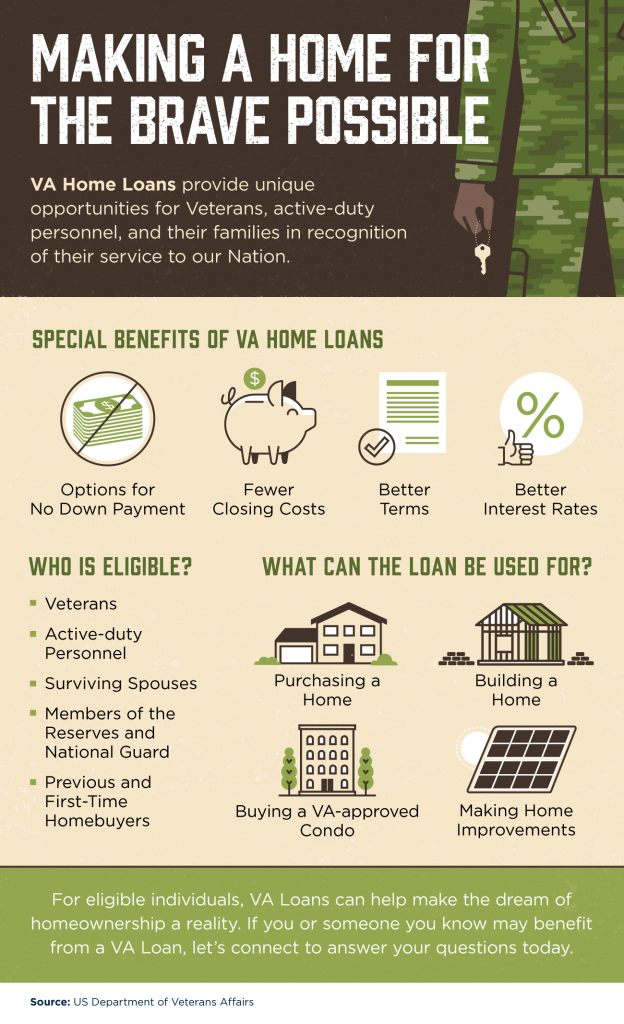

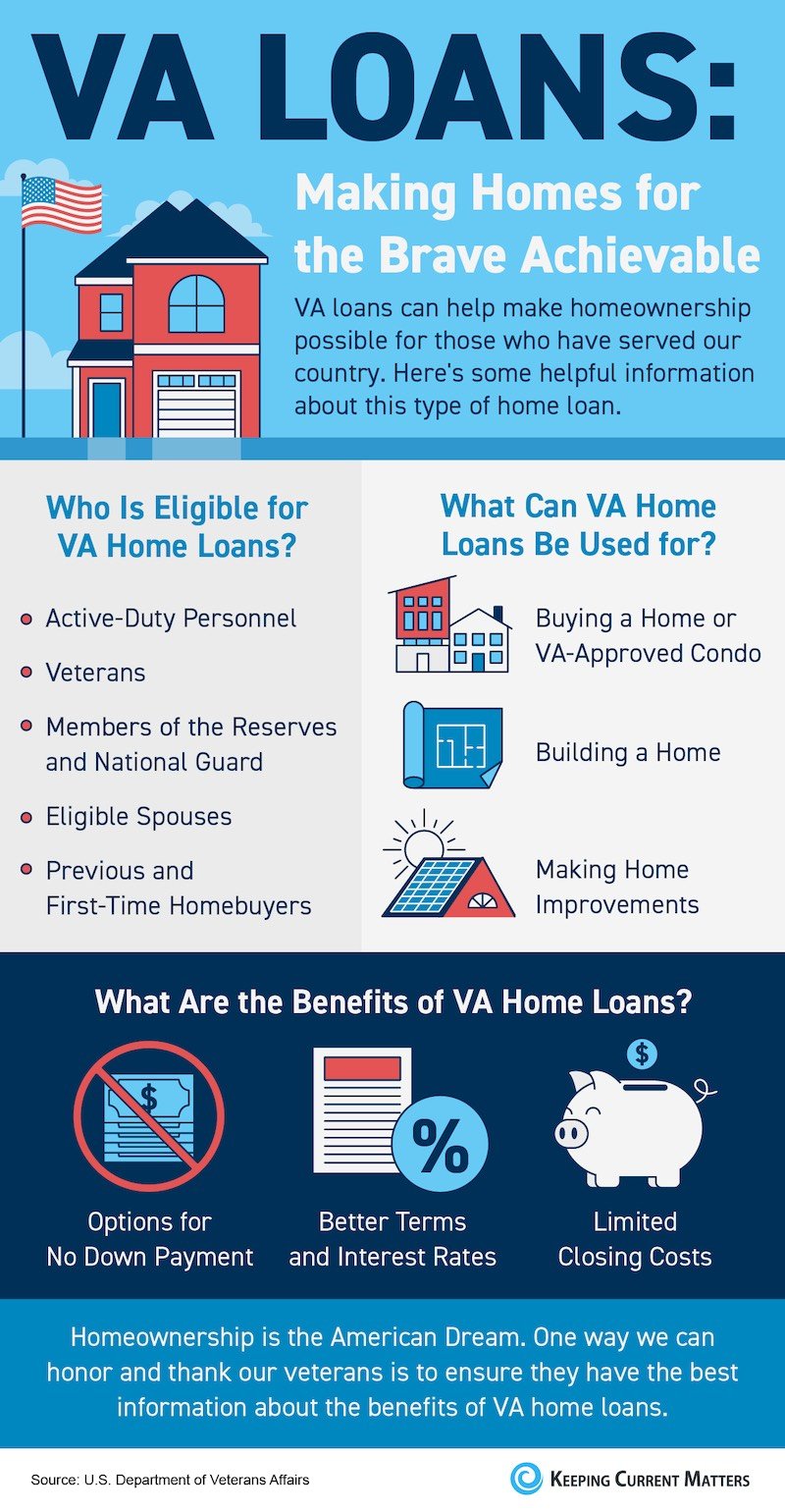

VA financings, offered to experts and active-duty army personnel, offer beneficial terms such as no deposit and no exclusive home loan insurance policy (PMI) USDA fundings cater to country buyers, advertising homeownership in less largely populated locations with low-to-moderate income levels, likewise calling for no deposit.

Lastly, variable-rate mortgages (ARMs) supply reduced preliminary prices that change over time based on market conditions, while fixed-rate home loans supply stable month-to-month payments. Recognizing these options allows prospective house owners to make enlightened choices, straightening their monetary objectives with one of the most suitable finance type.

Comprehending Rate Of Interest

Rate of interest rates play a pivotal function in the home mortgage procedure, dramatically influencing the total expense of loaning. They are essentially the expense of borrowing money, shared as a percent of the lending quantity. A lower interest price can result in substantial financial savings over the life of the financing, while a greater price can result in boosted monthly payments and overall interest paid.

Rate of interest rates fluctuate based on various factors, including economic problems, rising cost of living rates, and the monetary plans of central financial institutions. A fixed price remains continuous throughout the car loan term, supplying predictability in monthly repayments.

Recognizing exactly how rates of interest function is vital for potential property owners, as they straight influence cost and economic preparation. It is recommended to compare prices from different lending institutions, as also a small difference can have a significant effect on the overall expense of the finance. By keeping up with market trends, customers can make informed choices that line up with their financial goals.

The Application Refine

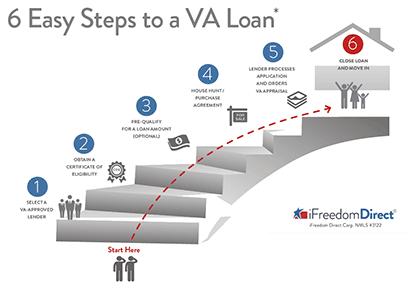

Browsing the home mortgage application process can initially appear challenging, however recognizing its crucial components can streamline the journey. The initial step involves celebration necessary paperwork, including evidence of revenue, income tax return, and a checklist of responsibilities and properties. Lenders require this info to evaluate your economic stability and creditworthiness.

Following, you'll need to select a lending institution that aligns with your financial needs. Research study numerous home loan items and interest rates, as these can significantly impact your month-to-month payments. As soon as you pick a lending institution, you will certainly finish a formal application, which might be done online or personally.

When your application is authorized, the lender will certainly issue a finance price quote, laying out the prices and terms related to the home mortgage. This critical record allows you to evaluate your choices and make notified decisions. Effectively navigating this application procedure lays a strong foundation for your trip towards homeownership and monetary security.

Handling Your Mortgage

Managing your mortgage successfully is crucial for maintaining financial health and wellness and making certain lasting homeownership success. A proactive approach to mortgage administration includes comprehending the regards to your loan, including rates of interest, payment routines, and any type of prospective charges. Consistently assessing your home mortgage declarations can help find out here you stay informed concerning your continuing to be equilibrium and settlement background.

Developing a spending plan that suits your home mortgage repayments is essential. Make certain that your month-to-month spending plan consists of not only the principal and interest but additionally real estate tax, house owners insurance policy, and maintenance expenses. This extensive view will prevent financial strain and unexpected expenses.

This strategy can dramatically decrease the total rate of interest paid over the life of the car loan and reduce the payment duration. It can lead to reduce month-to-month repayments or a more desirable car loan term.

Last but not least, preserving open interaction with your loan provider can provide clearness on options readily available ought to economic difficulties develop. By actively handling your mortgage, you can improve your economic stability and reinforce your path to homeownership.

Long-Term Financial Conveniences

Homeownership uses substantial long-lasting economic benefits that prolong past simple sanctuary. One of the most substantial advantages is the capacity for home appreciation. Gradually, property usually values in value, enabling Read More Here home owners to develop equity. This equity functions as an economic property that can be leveraged for future investments or to finance significant life occasions.

Additionally, homeownership supplies tax benefits, such as home loan interest reductions and real estate tax deductions, which can significantly decrease a home owner's gross income - VA Home Loans. These deductions can lead to significant financial savings, enhancing total economic security

Additionally, fixed-rate home loans safeguard property owners from rising rental prices, making certain foreseeable monthly payments. This security enables individuals to spending plan successfully and plan for future expenses, facilitating lasting monetary goals.

Homeownership additionally cultivates a feeling of area and belonging, which can bring about enhanced civic interaction and support networks, even more contributing to financial well-being. Inevitably, the economic advantages of homeownership, consisting of equity growth, tax advantages, and cost security, make it a keystone of lasting monetary protection and riches build-up for family members and people alike.

Final Thought

In final thought, understanding mortgage is necessary for navigating the path to homeownership and attaining economic security. By checking out different funding choices, comprehending rate of interest, and understanding the application procedure, prospective buyers equip themselves with the knowledge required to make enlightened decisions. Furthermore, effective mortgage management and acknowledgment of lasting monetary advantages contribute considerably to building equity and fostering area interaction. Ultimately, informed selections in home funding linked here result in boosted monetary safety and security and total wellness.

Browsing the complexities of home car loans is crucial for anybody aiming to achieve homeownership and develop economic security. As we think about these critical aspects, it comes to be clear that the path to homeownership is not simply about protecting a car loan-- it's concerning making informed options that can form your financial future.

Comprehending just how interest rates function is crucial for potential house owners, as they directly influence price and financial planning.Handling your mortgage efficiently is essential for preserving monetary wellness and ensuring long-term homeownership success.In final thought, comprehending home financings is essential for navigating the path to homeownership and attaining financial stability.

Report this page